Which of the Following Best Describes the Time Period Assumption

Estimates should not be made if a transaction affects more than one time period. The time period assumption states that.

Workout Log Templates 10 Free Printable Excel Word Pdf Workout Log Workout Templates

It is the cutoff point for asset and liability recognition.

. Assumes that the economic life of a business is divided into periods oftime. 56A companys calendar year and fiscal year are always the same. 58Income will always be greater under the cash.

Companies must wait until the calendar year is completed to prepare financial statements. Adjustments to the enterprises accounts can only be made in the. Expert answeredalfred123Points 811 Log in for more information.

Accrual and going concern. Updated 6302018 123958 PM. The time period principle is the concept that a business should report the financial results of its activities over a standard time period which is usually monthly quarterly or annually.

The economic life of a business can be divided into artificial time periods. Financial statements users expect full disclosure of all events throughout the entire time period translated in dollars. Asked 11112012 51747 PM.

The time periods are artificial in the span of which a firm works under this assumption. Companies record information in the time period in which the events occur. The time period assumption states that.

A coworker told you that you dont need to do an NPV analysis of the projects because you already know that project A will have a larger NPV. It assumes we value a business as of the end of every month. The time period assumptionsupposition statesgive that working of a businessfirm organization can be dividedseparated into simple and different time periods time like a year month week and so on and therefore it is known as periodicity assumption.

Accrual basis of account. The time period assumption is necessary because. Time Period Assumption in Accounting.

Accounting questions and answers. Going concern and time period. These time periods are known as accounting periods for which companies prepare their financial statements to be used by various internal and external parties.

The conceptual framework specifically mentions two underlying assumptions namely. Financial Accounting with Connect Plus 8th Edition Edit edition 80 4757 ratings for this books solutions. The economic life of a business can be divided into artificial time periods.

Revenue should be recognized in the accounting period in which it is earned. The time period assumption also known as periodicity assumption and accounting time period concept states that the life of a business can be divided into equal time periods. Accrual and accounting entity.

It implies that financial statements are prepared at the end of a business entitys operating cycle. Companies use the fiscal year to report financial information. Which of the following best describes the time period assumption.

The time period assumption is also referred to as the periodicity assumption. Which of the following best describes the time period assumption. The fiscal year should correspond with the calendar year.

It is the cutoff point for asset and liablity recognition O It assumes we divide the long life of a business into a series of shorter time periods for accounting and reporting purposes O It assumes we value a business as of the end of every month. Which of the following is NOT a common time frame for which a business could prepare its financial information using the. It assumes we divide the long life of a business into a series.

Both projects require the same investment amount and the sum of cash inflows of project A is larger than the sum of cash inflows of project B. Types of adjusting entries. It implies that financial statements are prepared at the end of a.

This preview shows page 2 - 4 out of 52 pages. O It implies that financial. It is the cutoff point for asset and liability recognition.

This answer has been confirmed as correct and helpful. It assumes we value a business as of the end of every month. Which of the following best describes the time period assumption.

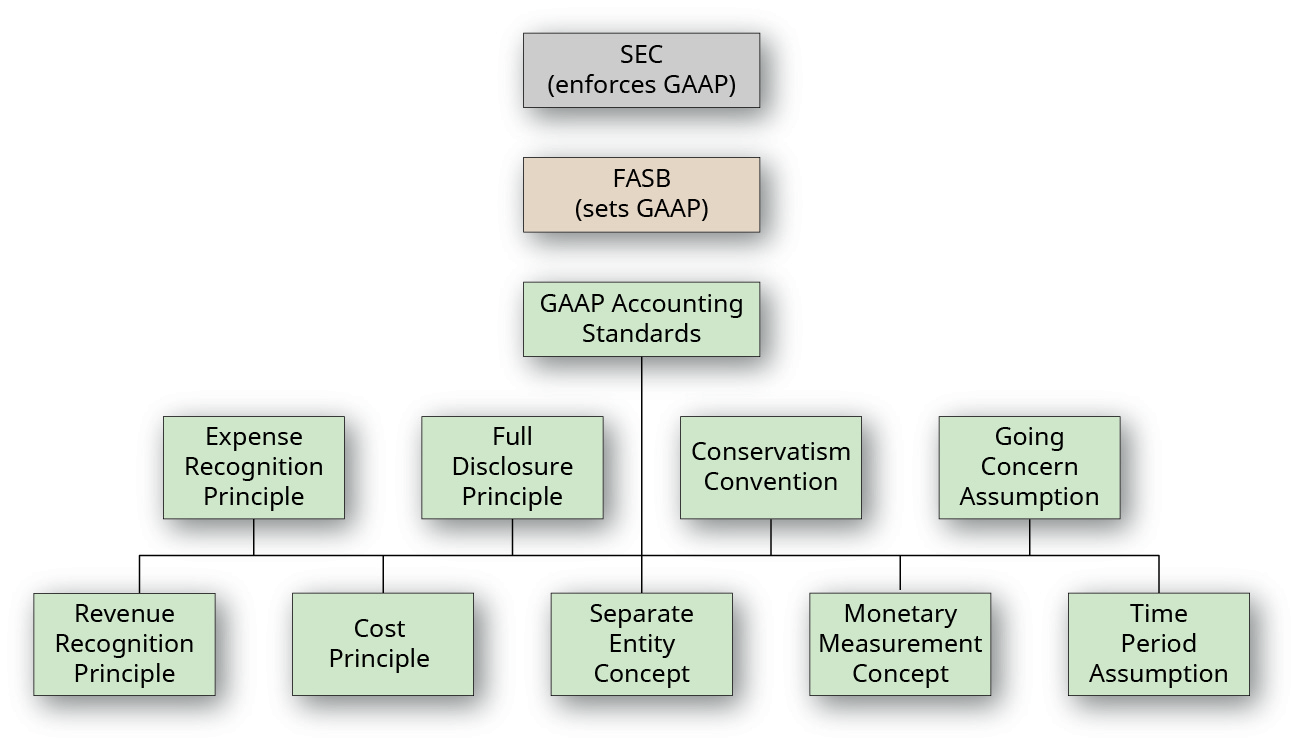

Which of the following best describes the time period assumption. It is the cutoff point for asset and liability recognition. Once the duration of each reporting period is established use the guidelines of Generally Accepted Accounting Principles or International Financial.

Project A and project B are two mutually exclusive projects. Patricia Libby Robert Libby Rent Buy. Inflation exists and causes confusion swings in financial statement amounts over time c.

The periodicity assumption assumes that. 57Accounting time periods that are one year in length are referred to as interim periods. It is required by the federal government.

Which of the following terms best describes financial statements whose basis of accounting recognizes transactions and other. Expenses should be matched with revenues. Time period and monetary unit.

It means that companies record events when they occur before it is handled with cash. 55The time period assumption is often referred to as the expense recognition principle. A transaction can only affect one period of time.

Accounting Principles Explanation Accountingcoach

The Fourth Glorious Mystery The Assumption Of The Virgin Titian 1516 18 Possibly The Most Famous Rendition Renaissance Art Renaissance Paintings Painting

Describe Principles Assumptions And Concepts Of Accounting And Their Relationship To Financial Statements Principles Of Accounting Volume 1 Financial Accounting

No comments for "Which of the Following Best Describes the Time Period Assumption"

Post a Comment